Executive Summary

Private equity (PE) firms are at a pivotal moment. They are experiencing a slowdown in fundraising and facing stronger competition. To thrive, they must strategically engage with high-net-worth individuals (HNWIs) and defined-contribution (DC) retirement plans. This shift toward democratizing private markets presents a golden opportunity to expand access to alternative investments.

However, reaching this goal requires overcoming significant hurdles. Firms must navigate complex regulations, enhance investor education, and address operational challenges. Here, technology is vital. Innovations like artificial intelligence (AI), blockchain, digital onboarding, and wealth management platforms are essential tools for overcoming these obstacles.

This paper will illustrate how PE firms can harness digital innovation, refine their access models, and adapt to regulatory changes. By doing so, they can successfully grow their investor base in the private markets, paving the way for a more inclusive investment landscape.

New Access Models

Private equity firms are changing how they make capital available to reach more investors. A key strategy is to create investment options that are easier for everyday people to access, often working with well-known asset managers like Vanguard. These semi-liquid private equity exchange-traded funds (ETFs) allow individual investors to participate by lowering the minimum investment amounts and enhancing liquidity. Recent regulatory updates, such as changes to the Employee Retirement Income Security Act (ERISA), now allow private equity to be included in 401(k) plans, making it more appealing to mainstream investors.

Wealth managers are essential in this transformation, particularly when it comes to serving high-net-worth individuals (HNWIs). For example, Hamilton Lane is paving the way with evergreen and semi-liquid fund structures. These allow for ongoing subscriptions and redemptions that align better with personal liquidity needs. Often, these investment products include personalized advisory services aimed at educating investors and addressing risk management concerns.

Defined contribution plans also present a significant opportunity. With over $7.7 trillion in assets, 401(k) accounts have great potential to integrate private equity. Organizations are launching investment vehicles that meet fiduciary standards, giving access to previously restricted asset classes. Together, these new models show a strategic shift towards more inclusivity in private markets.

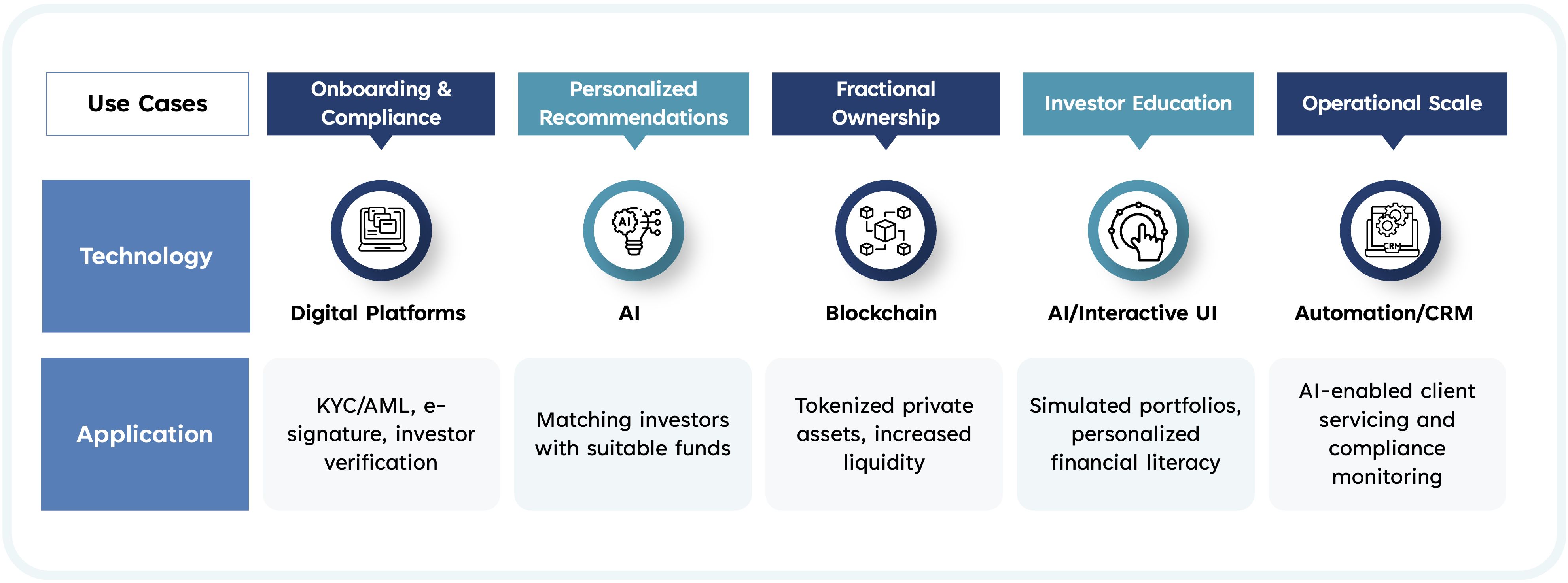

Key Technology Enablers

Technology is key to opening up private markets for everyone. Digital onboarding platforms like iCapital and Moonfare have changed how investors interact by making identity verification, regulatory compliance, and fund subscriptions easier. These platforms can handle a large number of individual investors, which is crucial for expanding access universally.

Artificial intelligence (AI) is increasingly important in linking investors with suitable private market opportunities. By analyzing financial profiles and preferences, AI tools provide personalized investment recommendations while helping to meet regulatory standards. This not only boosts efficiency but also builds trust among new investors.

Blockchain technology is revolutionizing how assets can be accessed through tokenization. By turning real estate or private equity assets into fractional digital tokens, firms can offer investments that were once out of reach for most people. The transparency and possibility for secondary trading make these investments even more attractive.

Additionally, digital wealth management solutions enhance investor engagement and understanding. Tools such as robo-advisors and AI-driven financial education resources simplify complex financial products, promote financial literacy, and create user-friendly experiences that resonate with a wider audience.